Debt Collection Software Solutions

for businesses

Increase Collection rates, streamline workflows, reduce costs and human efforts, track and analyse with efficiency and more, with our dedicated Debt management software solutions.

Trusted Organizations Globally Using Maxyfi

Maxyfi's Surprising Benefits

Bringing a Revolution to Collection with our Cutting-edge Collection Software

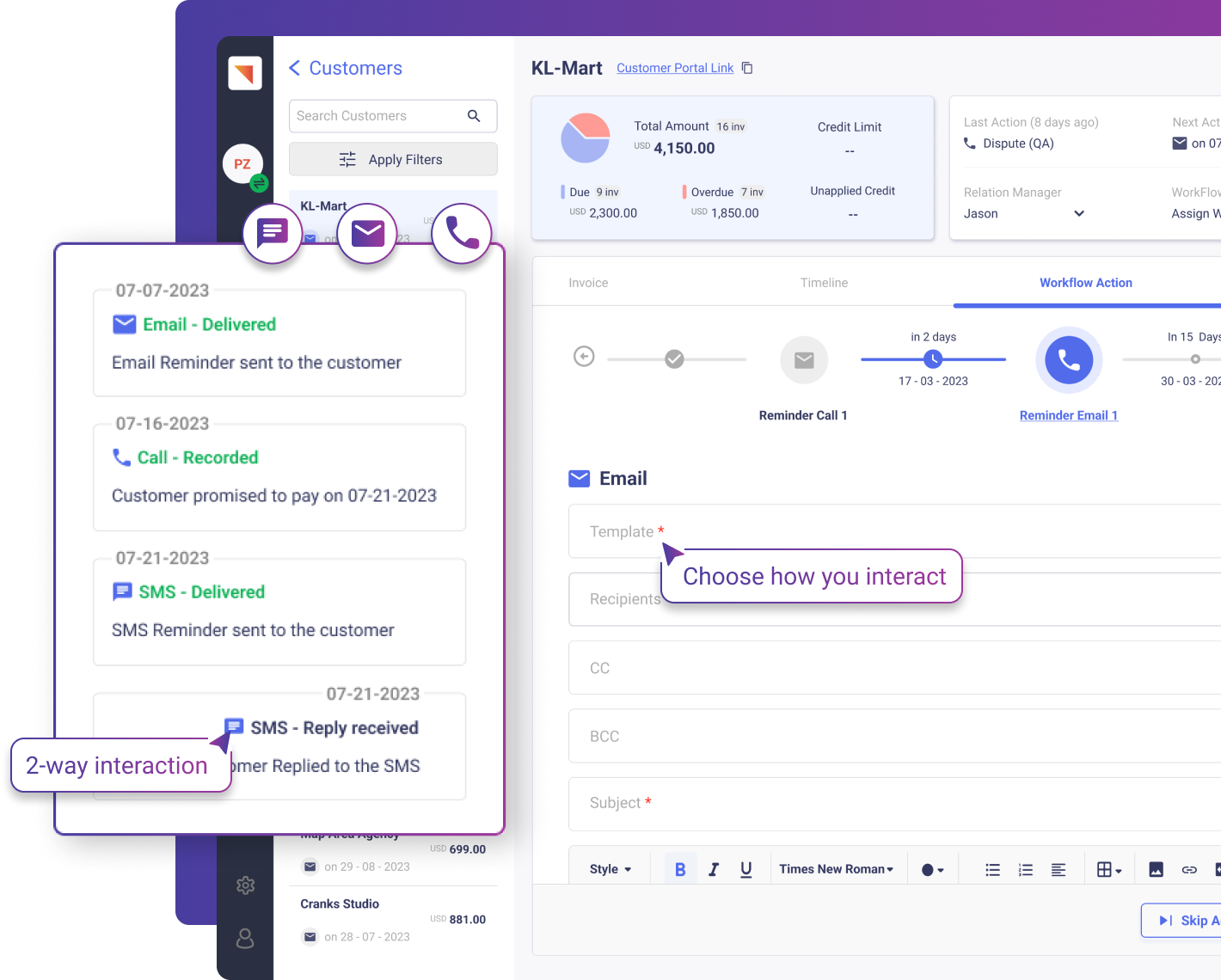

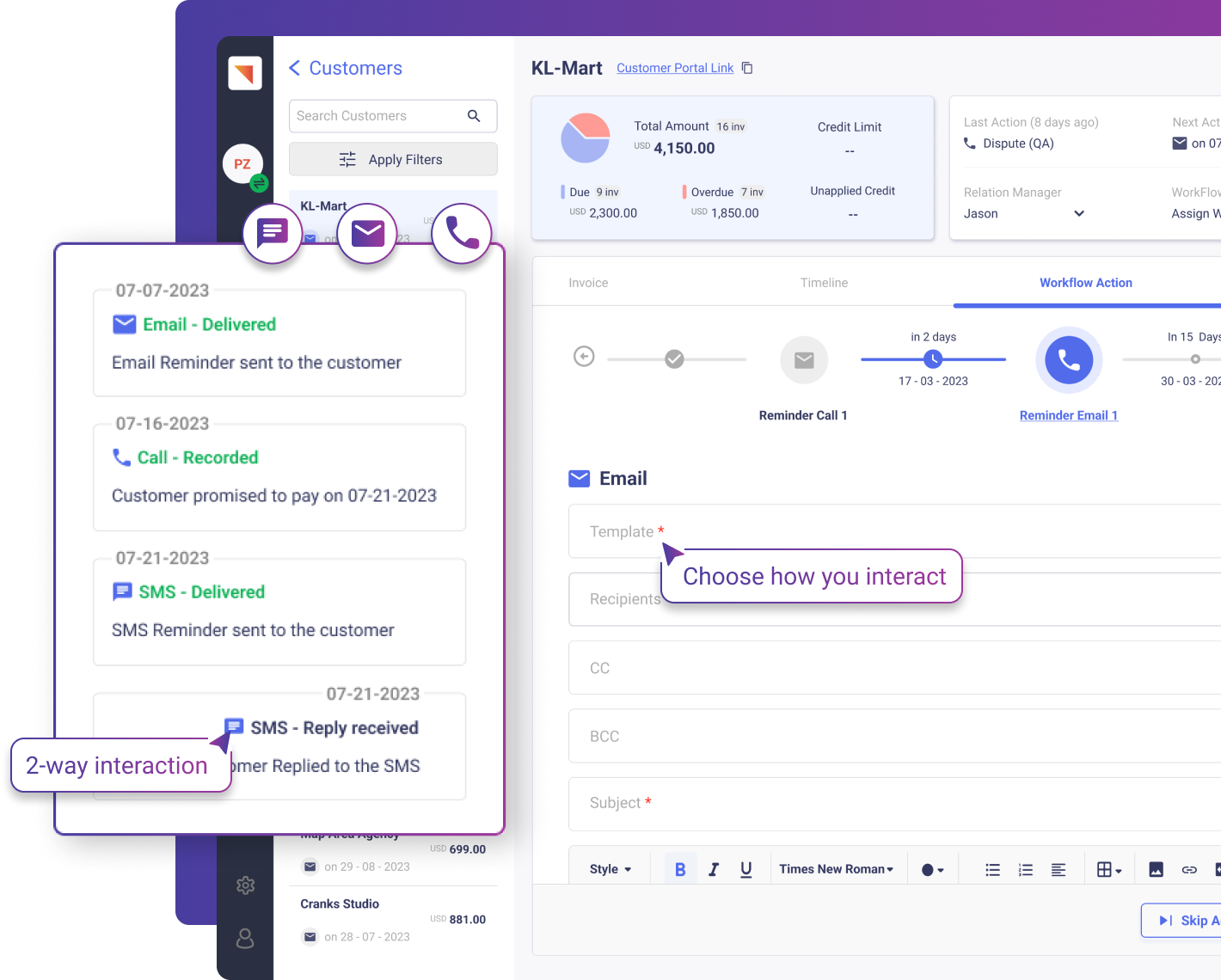

Outreach

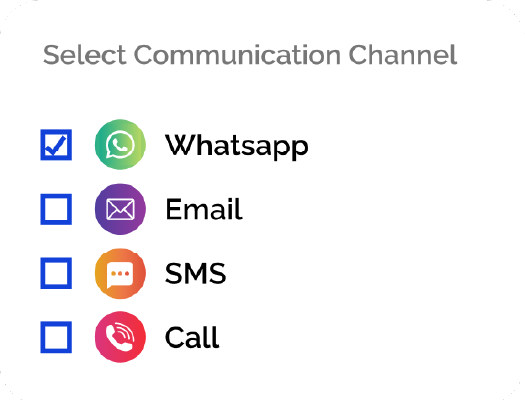

Engage customers at the right time, place, and channel with our maxi-Connect feature, enabling automated and seamless 2-way Email, SMS, and Call interactions for a more effective debt recovery process.

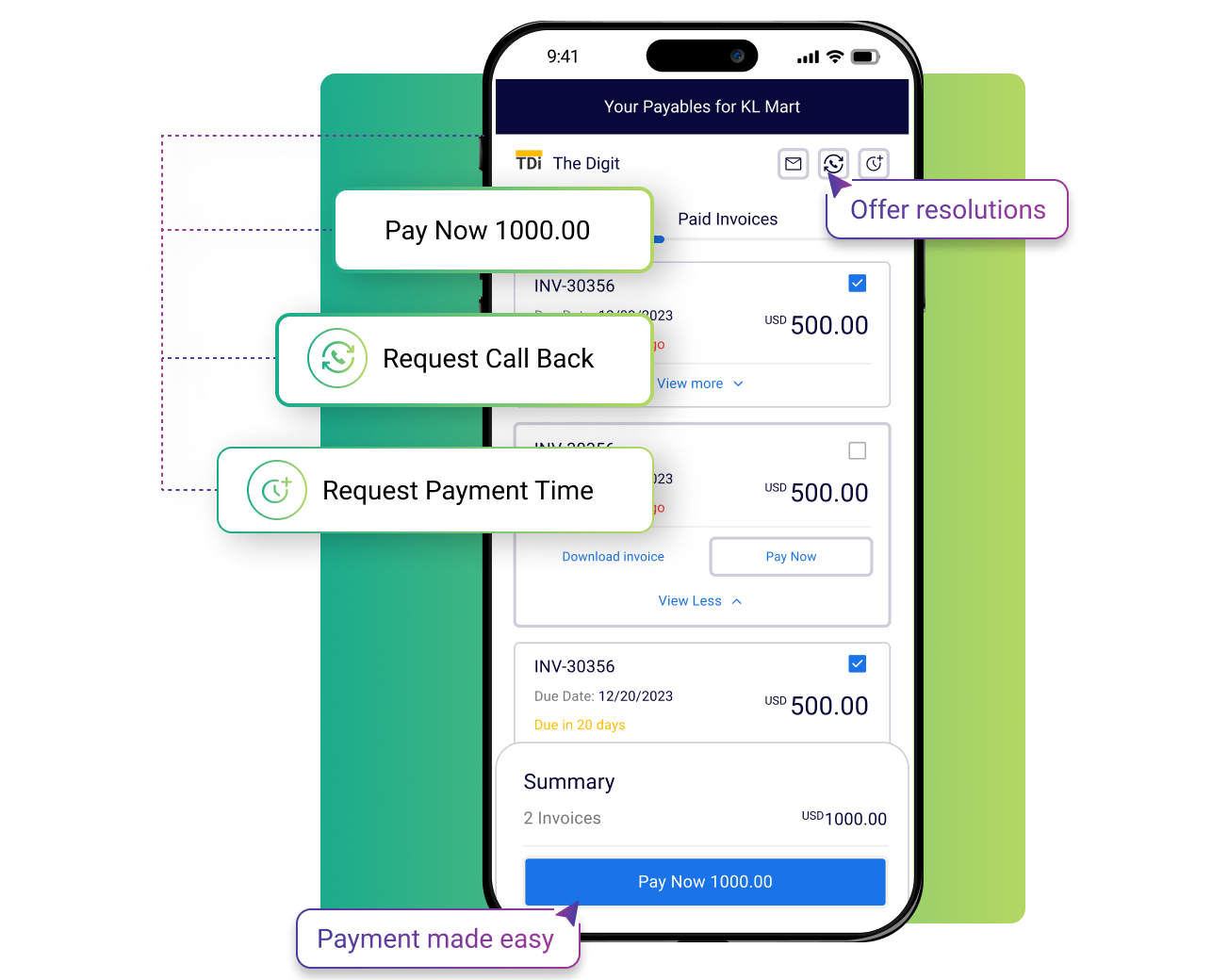

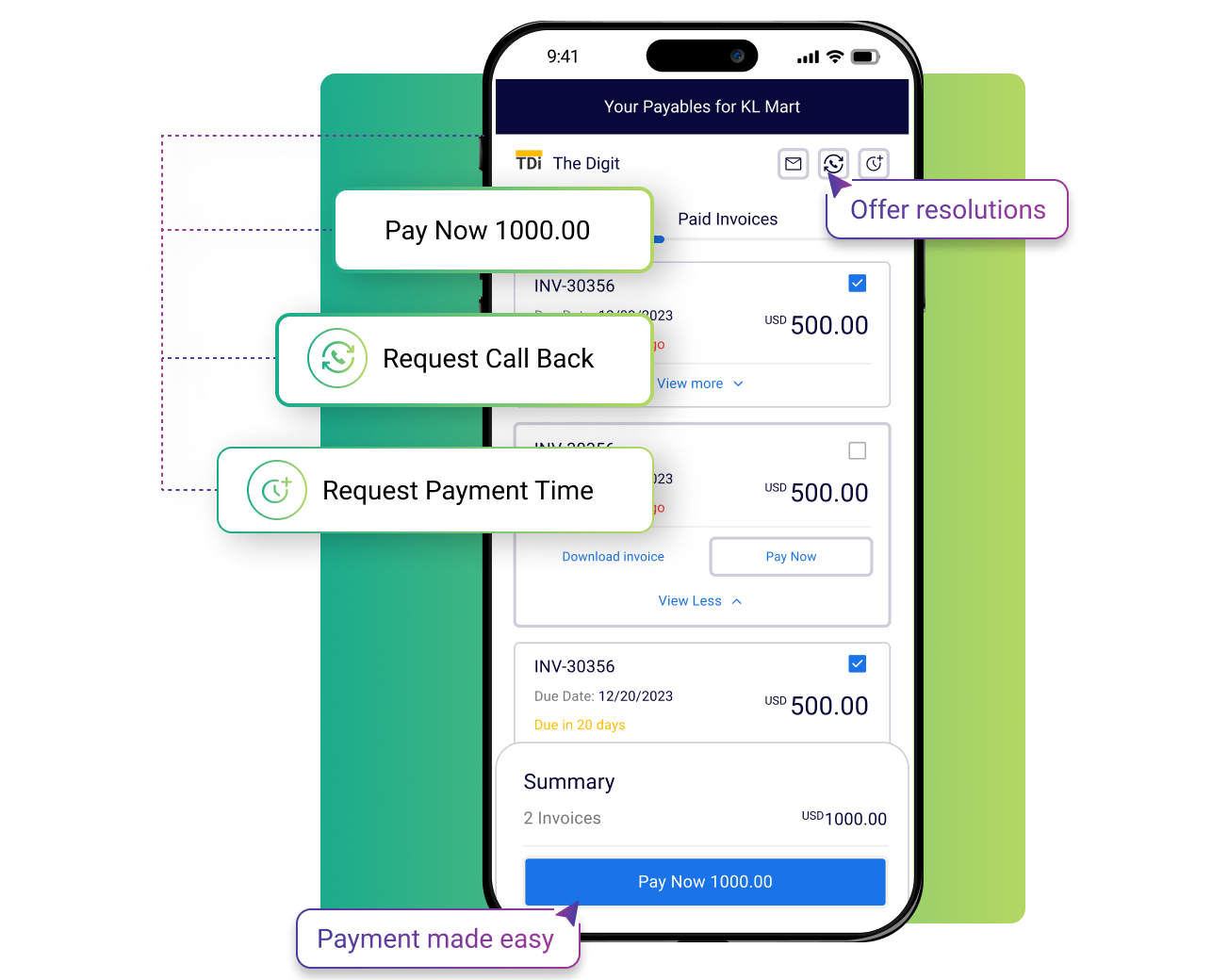

Self-Resolve Portal

Empower customers to self-resolve debts with just a click of a link. Maxi-Resolve provides secure and integrated payment and customer self-service options that help to resolve 40% of the debt resolution.

Intelligent Settlement Option

Give personalized debt resolution options for each customer at the most appropriate time. Maxyfi's Intelligent Settlement Option lets you automate settlement strategies and yet keep it personalized for successful collection.

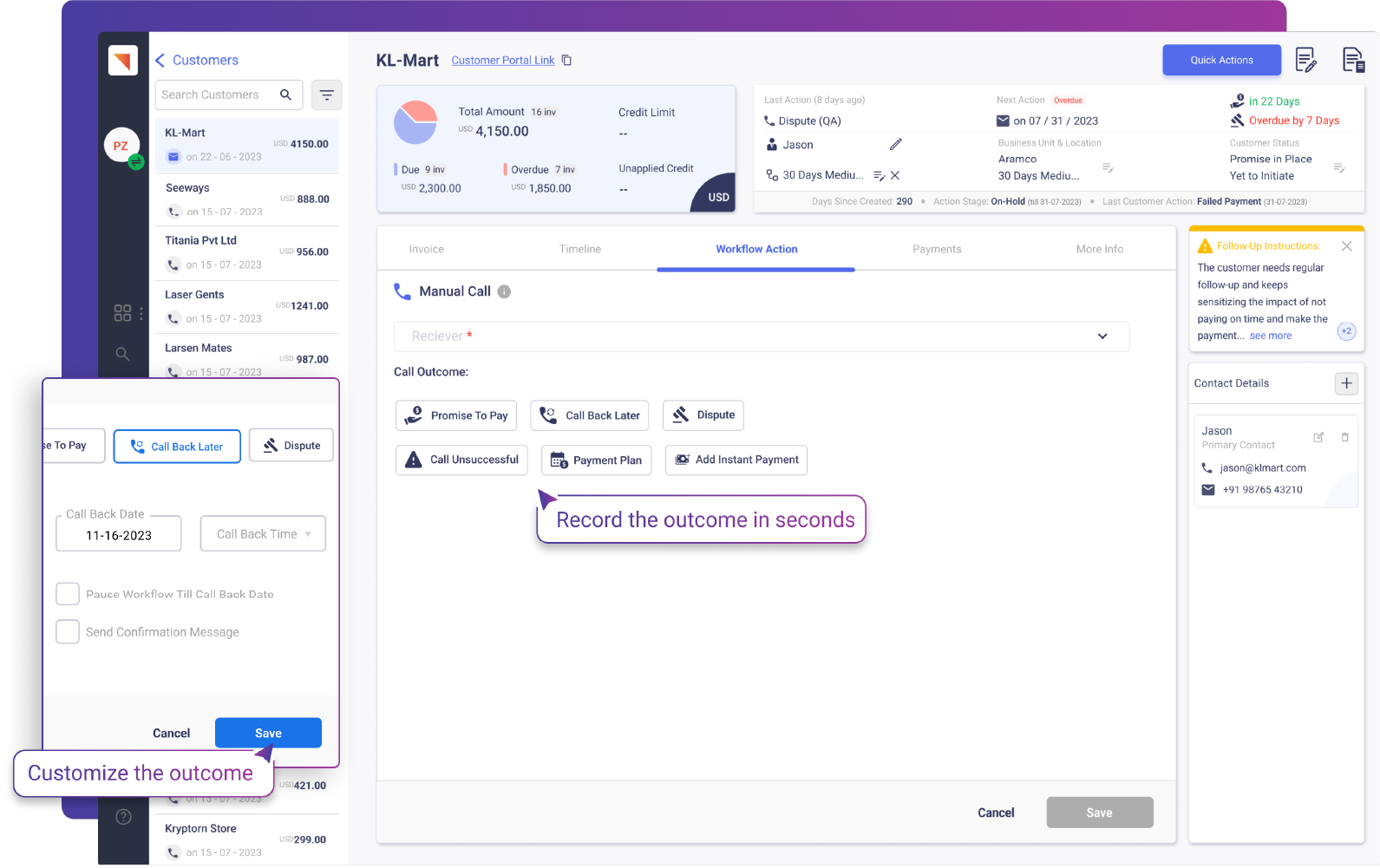

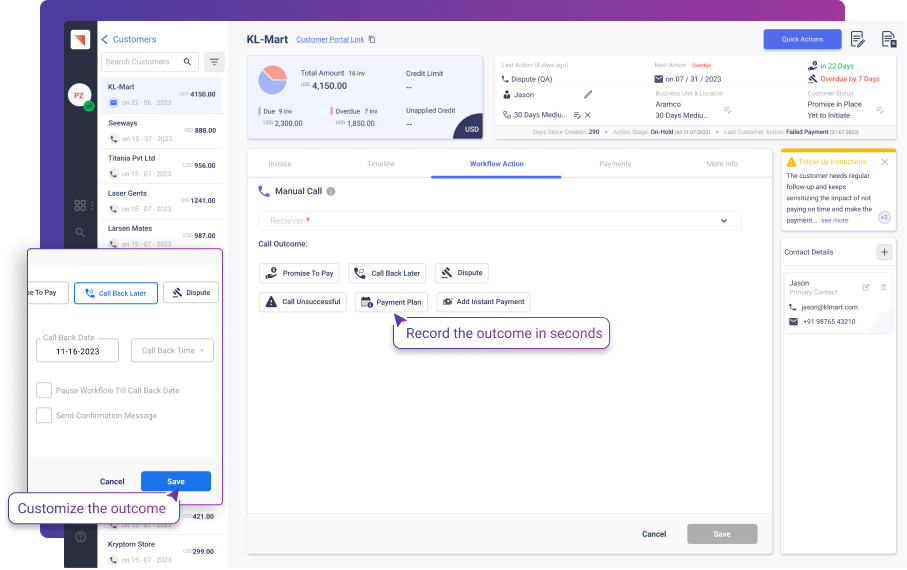

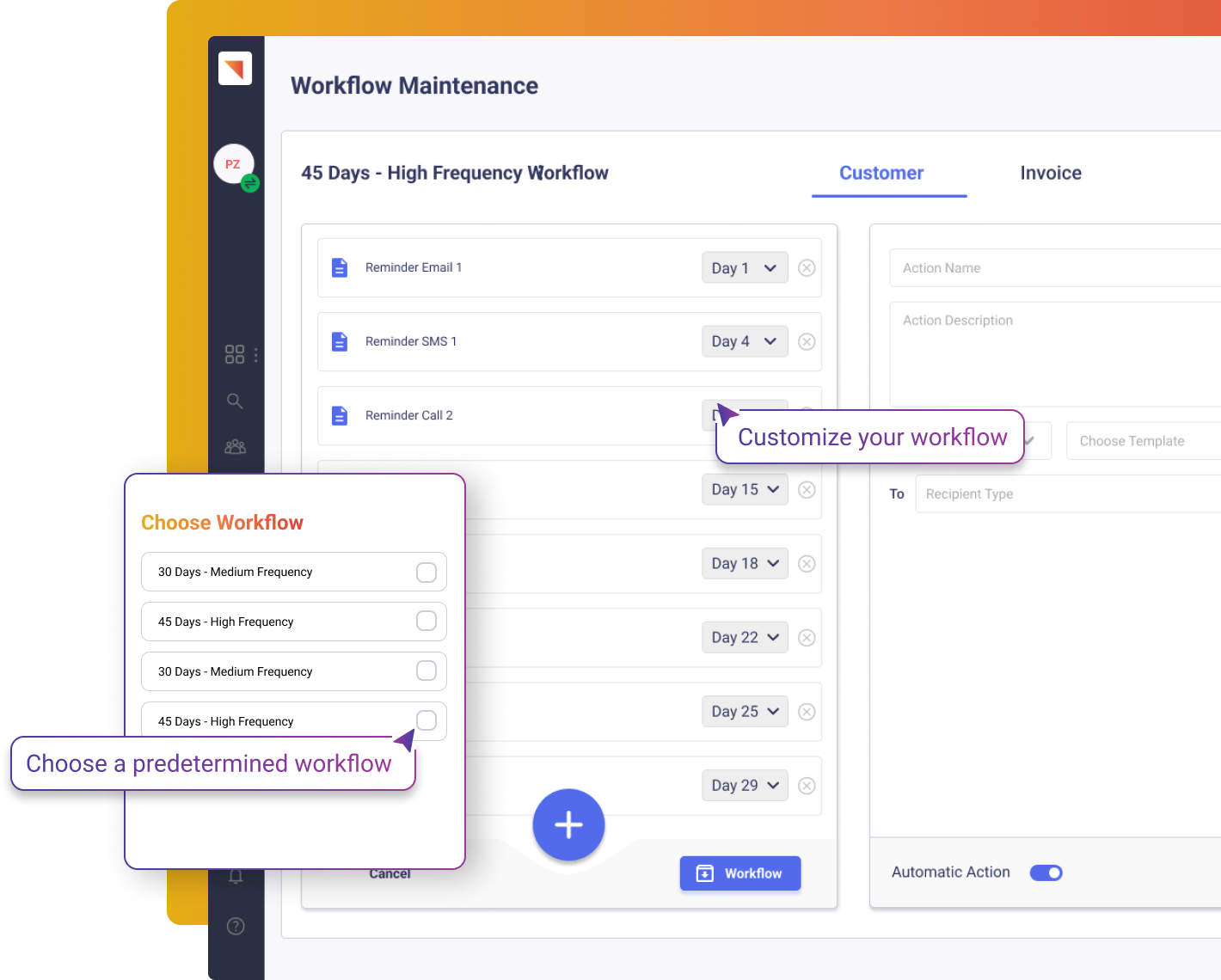

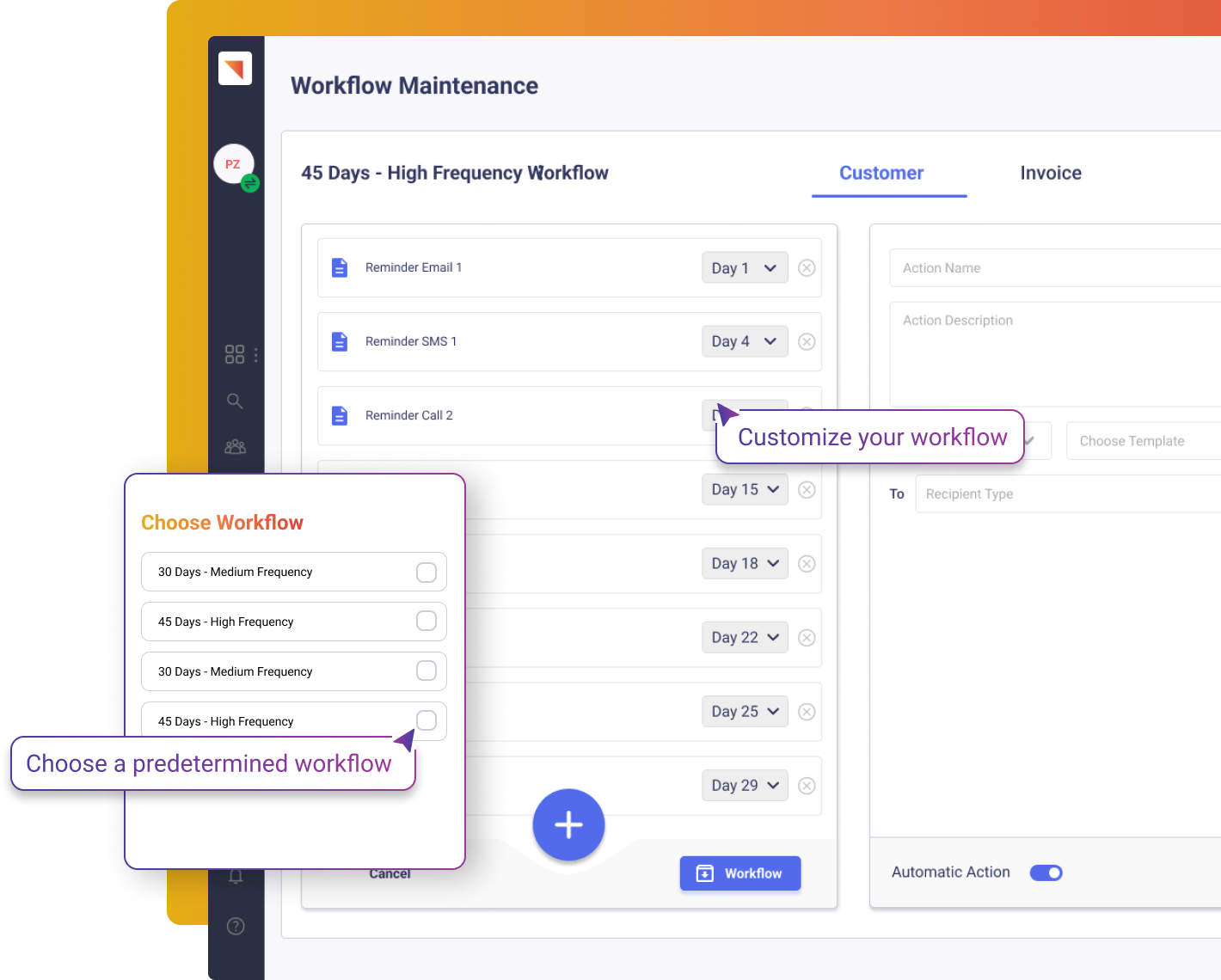

Smart Workflows

Double your Collection efficiency with our Intelligent automation of communications, optimized disposition handling, and robust end-to-end recovery processes. Boost productivity significantly while minimizing manual intervention.

Maxyfi's Surprising Benefits

Bringing a Revolution to Collection with our Cutting-edge Collection Software

Outreach

Engage customers at the right time, place, and channel with our maxi-Connect feature, enabling automated and seamless 2-way Email, SMS, and Call interactions for a more effective debt recovery process.

Self-Resolve Portal

Empower customers to self-resolve debts with just a click of a link. Maxi-Resolve provides secure and integrated payment and customer self-service options that help to resolve 40% of the debt resolution.

Intelligent Settlement Option

Give personalized debt resolution options for each customer at the most appropriate time. Maxyfi's Intelligent Settlement Option lets you automate settlement strategies and yet keep it personalized for successful collection.

Smart Workflows

Double your Collection efficiency with our Intelligent automation of communications, optimized disposition handling, and robust end-to-end recovery processes. Boost productivity significantly while minimizing manual intervention.

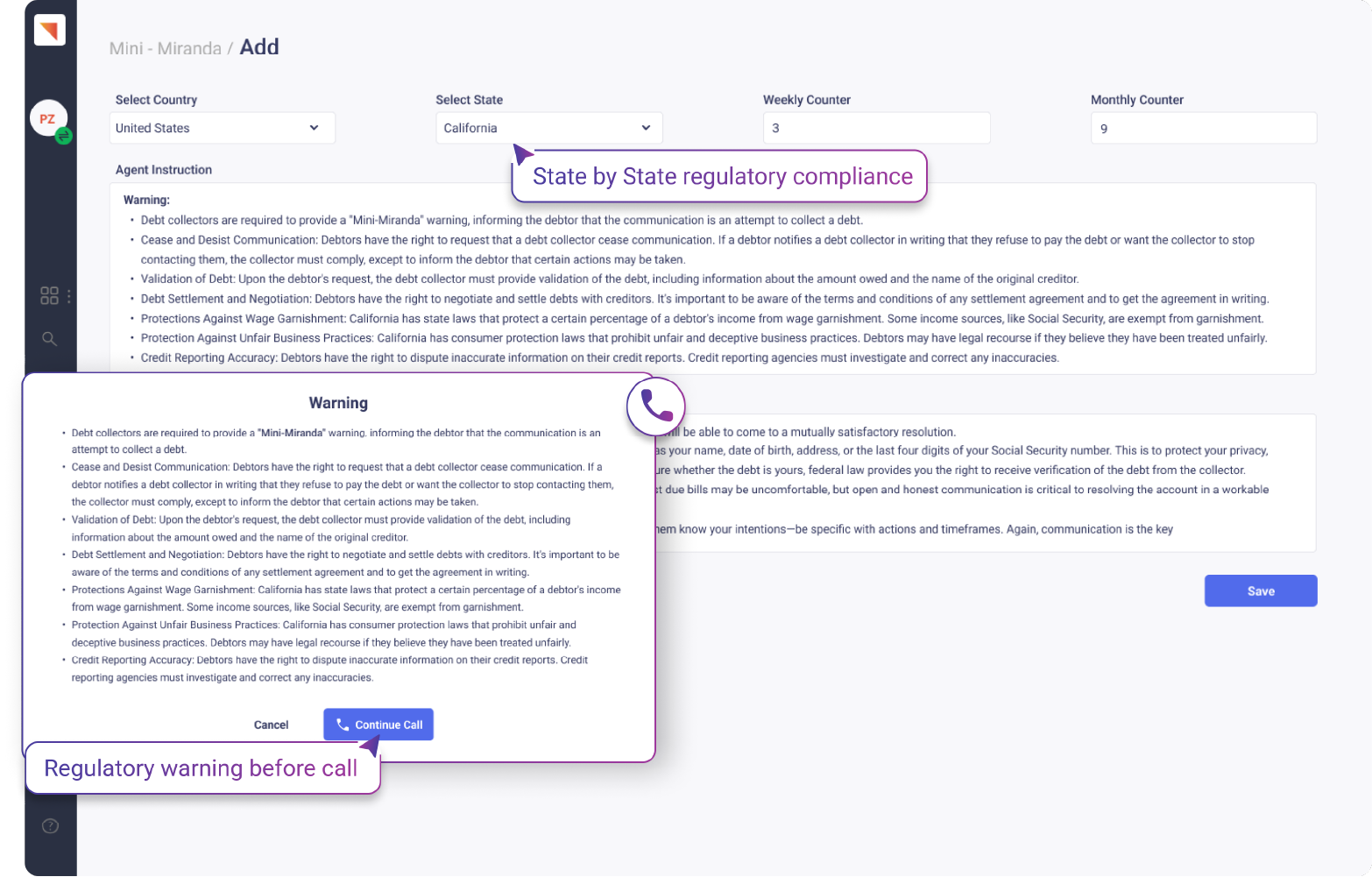

Reg F & compliance

Stay compliant effortlessly with Maxyfi's robust regulatory framework, ensuring adherence to Regulation F and other industry standards for ethical and lawful debt collection practices.

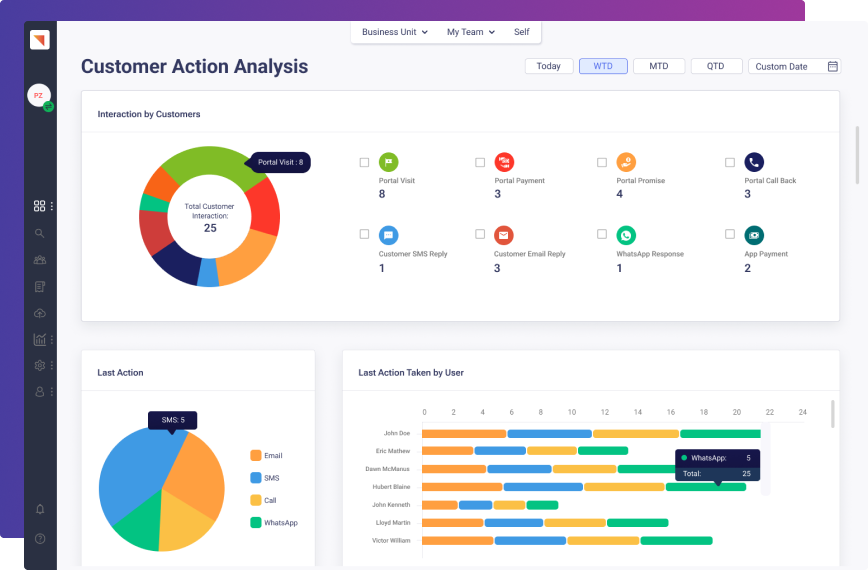

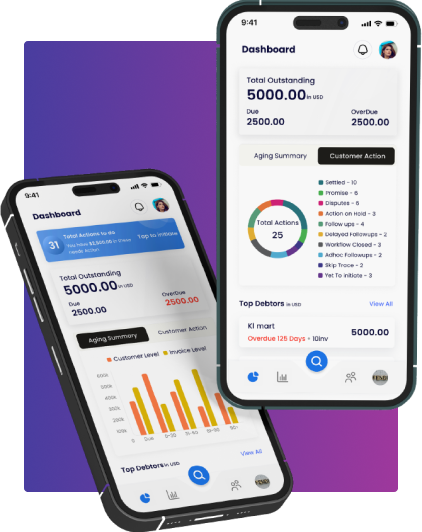

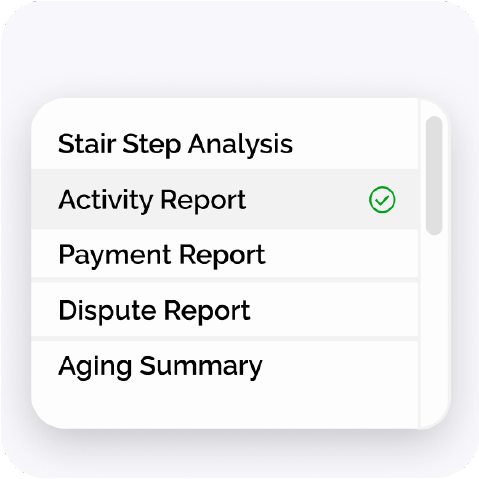

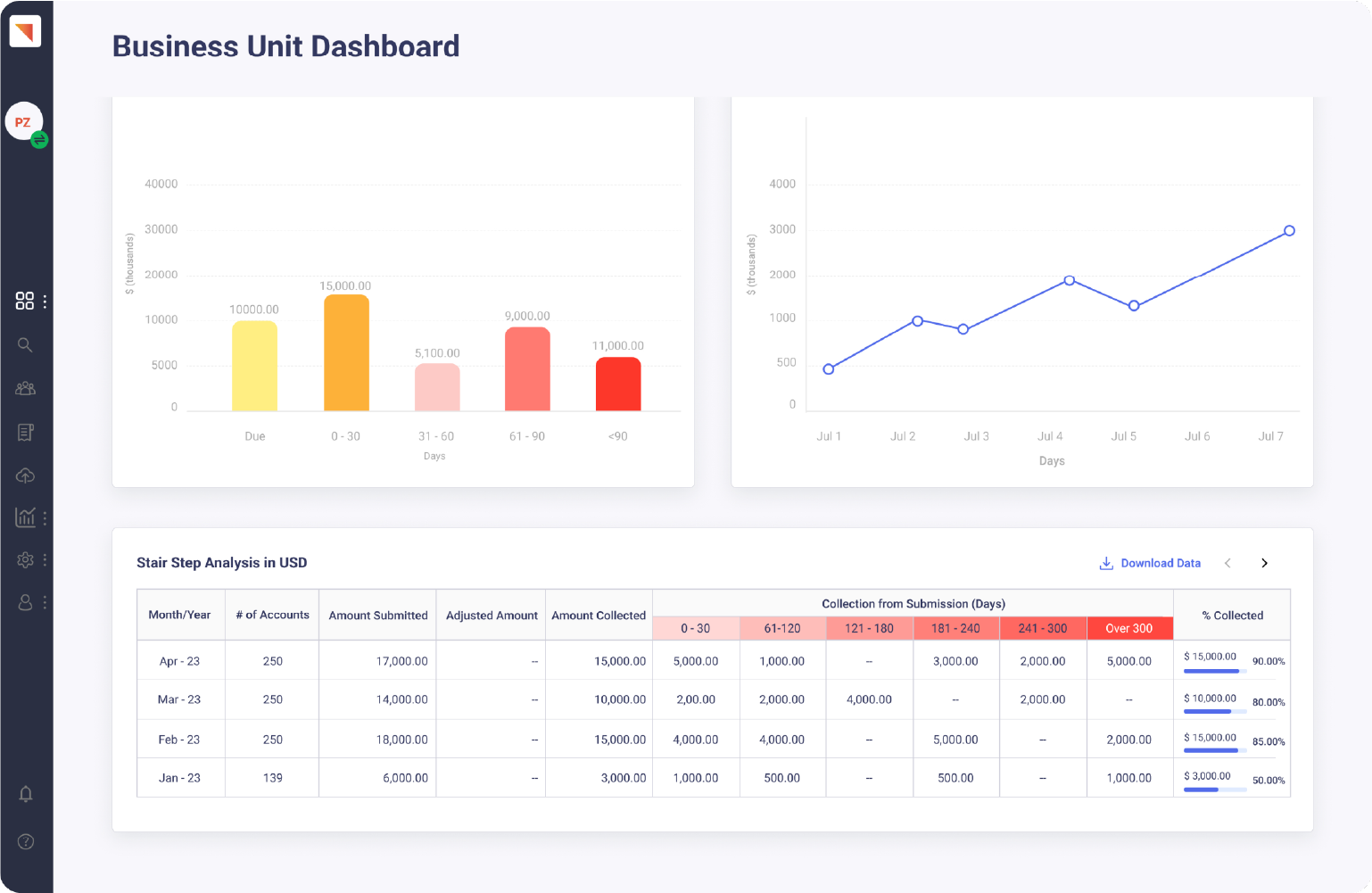

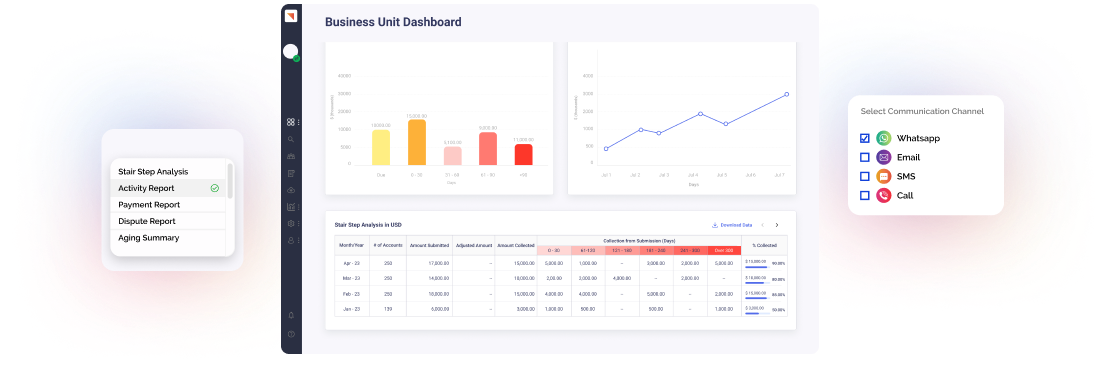

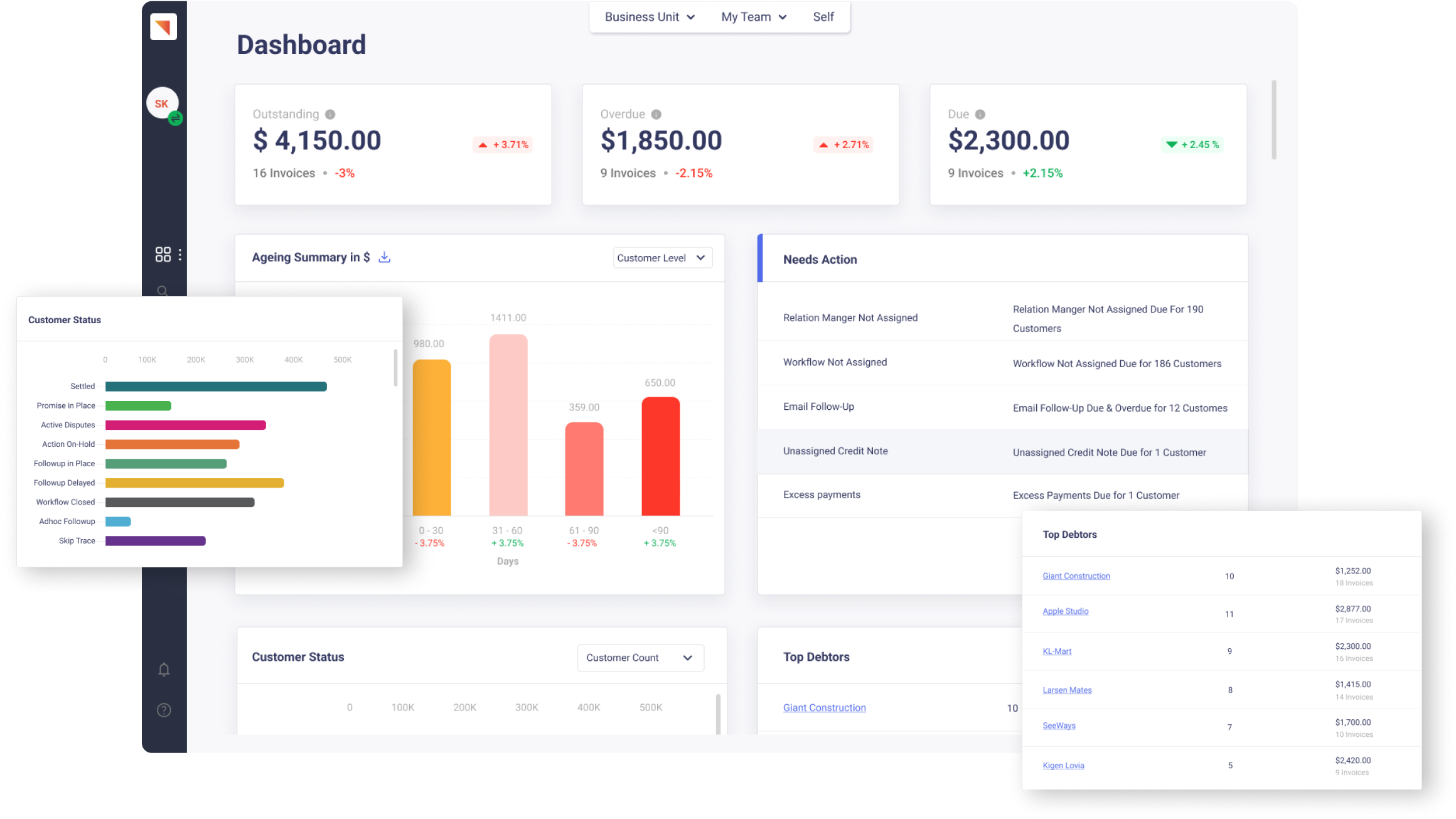

Dashboards & Reports

Access over 30 visualizations and dashboards for in-depth insights into your collection progress. Configure customer and invoice level reports, along with a range of operational reports, empowering you to stay in control of critical actions, meet audit requirements, and manage agent productivity effectively.

Handle clients with ease

Bringing a Revolution to Collection with our Cutting-edge Collection Software

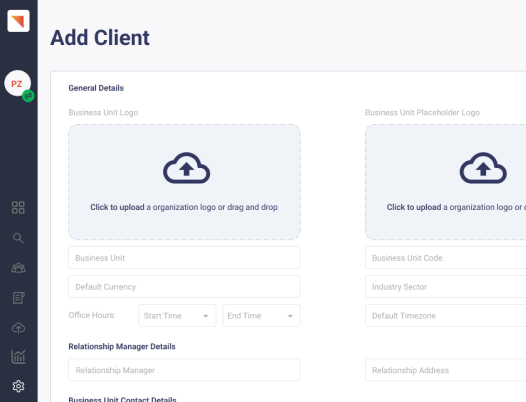

Seamless On-boarding of Clients

Effortlessly onboard new clients in under 30 minutes, ensuring a hassle-free experience from the start. Personalize strategies, communication, and data transfer swiftly, all without the need for coding.

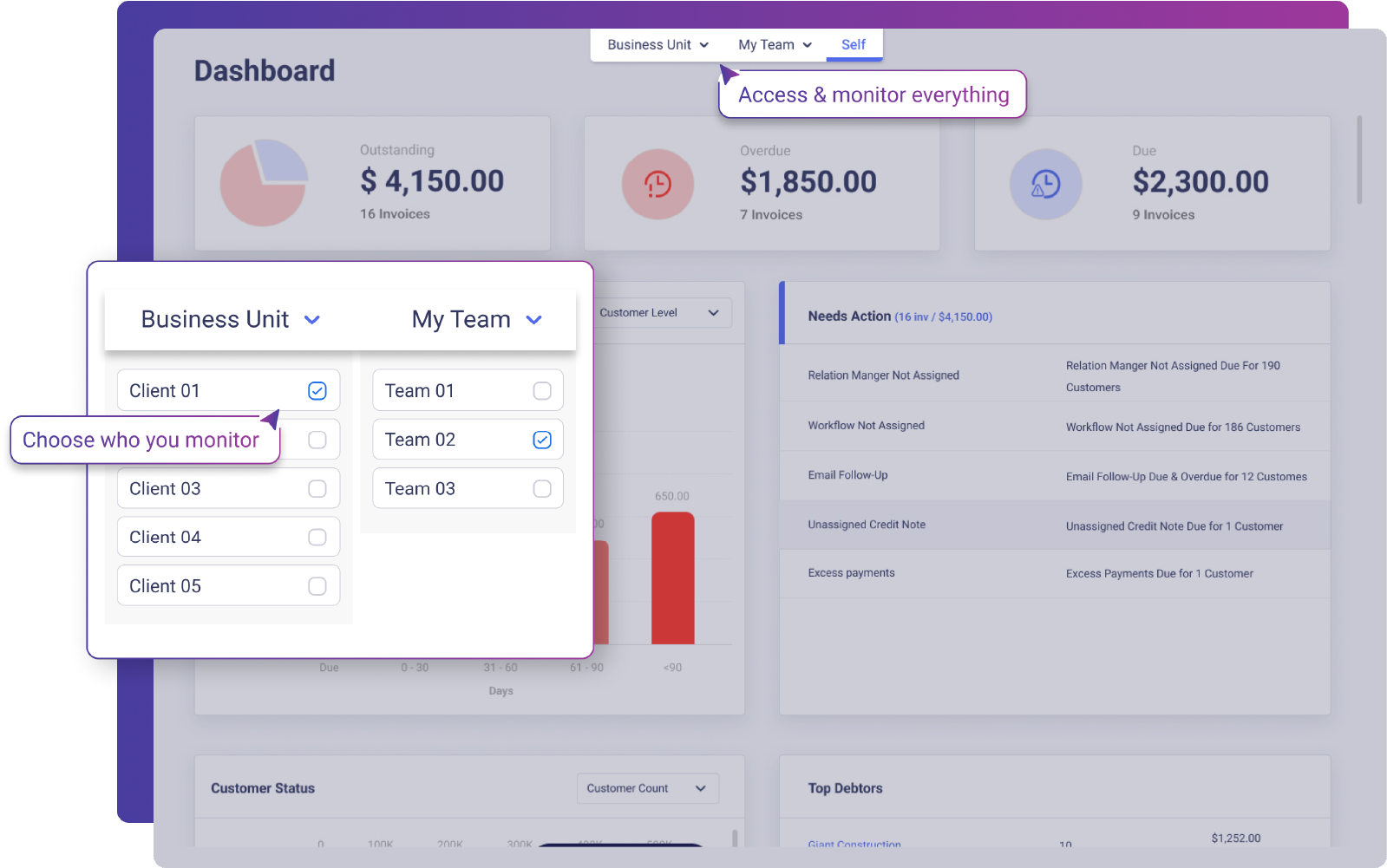

Access Control Re-imagined

Experience the simplicity of Maxyfi's unique Access Control, enabling seamless task assignment and monitoring at Team, Agent, and Client Portfolio levels

Ecosystem of Integrations

effortlessly connects with various tools including Payment Gateways, SMS Providers, Auto-Dialers, Cloud Telephony, Voice Apps, Skip Trace, and more, offering a unified and comprehensive 360-degree experience within Maxyfi

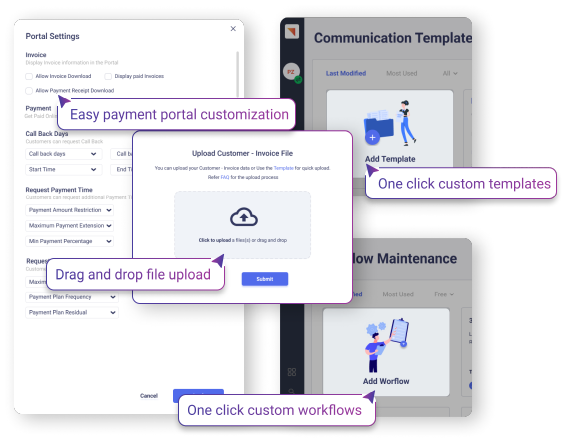

No-Code Low-Code Platform

Bring your ideas to life at the speed of thought with our user-friendly and configurable platform. No need for IT support—implement business plans seamlessly with Maxyfi's Configurable Workflow, Strategy, Integrations, Portal etc.

Fortify your Collections with Enhanced Security

Maxyfi's enhanced security feature protects your client's sensitive data by encrypting it, by using multiple-factor authentication, and storing it in secure servers.

Credit Reporting & Metro 2 File

The credit reporting feature automates and streamlines the process of reporting consumer credit information to credit bureaus, ensuring accuracy and compliance with regulations like the Fair Credit Reporting Act. This facilitates efficient dispute management and helps maintain positive consumer relations by ensuring fair representation of credit records. By using Maxyfi, you can download the Metro2 Format file for credit reporting purpose

Revolutionize Debt Collection Management with Advanced Software

Maxyfi, the premier provider of debt collection software, offers a comprehensive solution to meet all debt collection needs, including specialized debt collection agency software. The platform revolutionizes the debt collection process with its cutting-edge automated debt collection software, ensuring seamless and efficient management and quick recovery of debts. Maxyfi's debt collection software platform is equipped with a wide array of features designed to simplify and streamline debt management...Read More

Frequently Asked Questions(FAQ)

What is debt collection software?

Debt collection software is a tool that streamlines and automates the overall debt collection process of an organization. At Maxyfi, we offer a feature-rich platform that provides cloud-based debt recovery, efficient debt tracking, and compliance management for debt collectors.

How does debt collection software work?

Maxyfi's debt collection software works by easy client management, provides an intuitive portal, uploads data swiftly, progress tracking and automates remainders through omni-channel communication platform.

What are the benefits of using debt collection software?

With Maxyfi's debt collection software, you can see a considerable increase in collection rates, onboard clients at a shorter period, enable automated 2-way interactions on Email, SMS or call, ensure compliance, reduce manual effort and enhance decision-making.

Is debt collection software suitable for my agency?

Depending on each client's criteria, Maxyfi's debt collection software can be customized. However, using Maxyfi's debt collection software will notably increase debt recovery rates, resolve disputes, automate reminders, thereby reducing human error to a maximum.

Is debt collection software compliant with regulations?

Maxyfi Debt collection software is compliant with regulations, ensuring adherence to Regulation F and other industry standards for ethical and lawful debt collection practices.

Can debt collection software integrate with other systems?

Maxify's debt collection management software can integrate with other systems and tools including payment gateways, SMS providers, auto-dialers, voice apps etc.

What features should I look for in debt collection software?

Some of the primary features in Maxyfi’s debt collection software are:

Seamless client management – On-board new clients efficiently in a short period.

Omni-channel communication – Helps to interact with consumers either through call/Email/Whatsapp/ SMS or via letter.

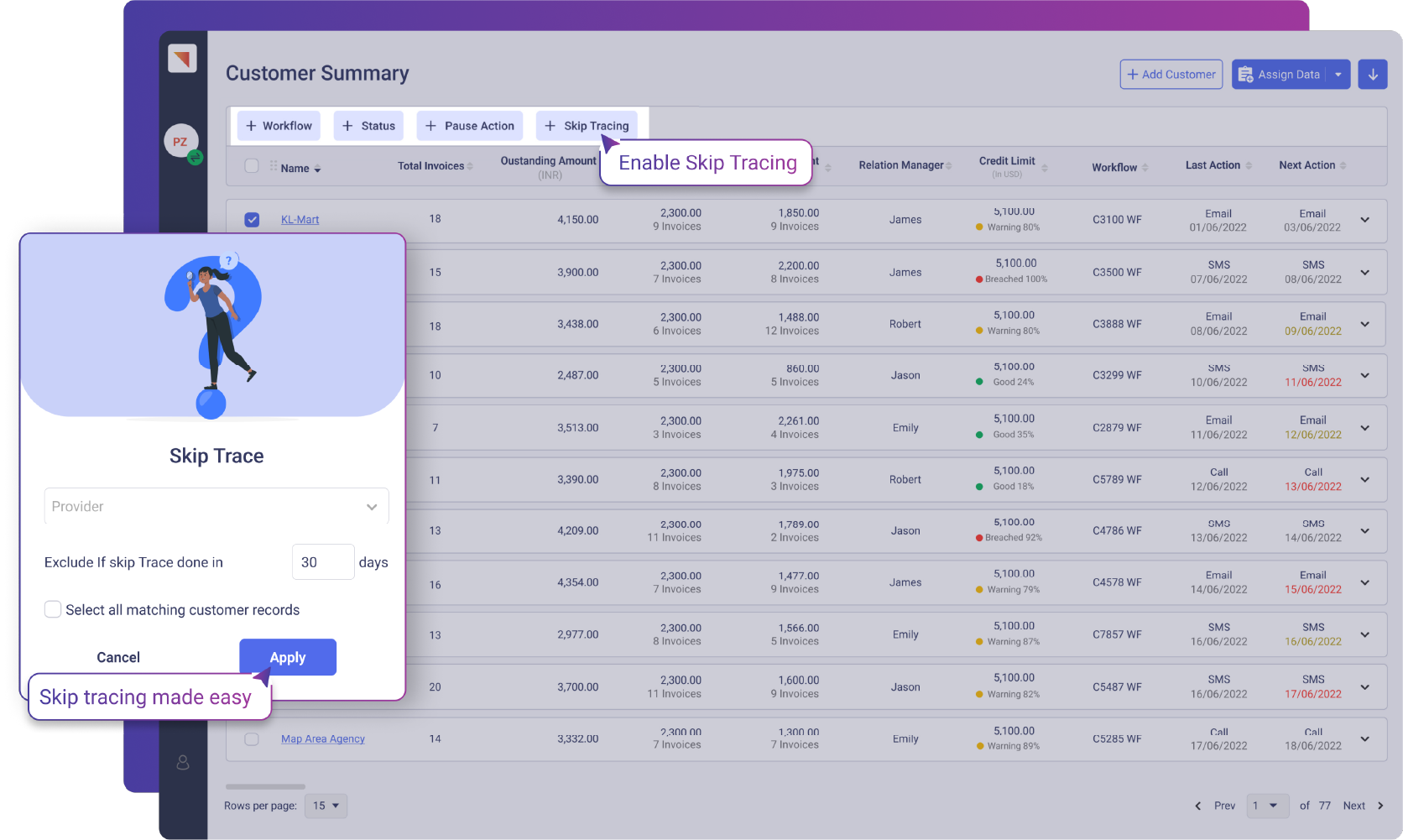

Skip-Trace – Swiftly find debtor information for establishing the Right Party Contact.

Self-resolve portal – Consumers can self-resolve their debts with a click of a link.

Progress Tracking - Monitor debt collection progress effortlessly on the go with mobile accessibility.

How secure is debt collection software?

Maxyfi debt collection software has an established Information Security Program, that adheres to the guidelines, outlined in the SOC-2 framework, a reputable information security audit process. The debt collection software has an enhanced security feature that protects sensitive data through encryption, two-factor authentication and stores them in secure servers

Can debt collection software help improve my collection rates?

Maxify's debt collection software will improve the collection rates in an organization by streamlining its debt collection process. Through omni-channel communication services, smart tracking functionalities, automated operations, and accurate consumer analytics, we can witness an increase in debt recovery.

How much does debt collection software cost?

Maxyfi’s debt collection software has a transparent and cost-effective price plan, that varies for different enterprises. Some prominent features in the plans are: An analytical dashboard, invoice & credit notes, promise to pay option, innovative out-reach and communication templates to streamline debt recovery.

Talk to an Industry expert. It’s Free.

Schedule a free consultation with our experts, to know more about how

the Debt Collection or Accounts Receivable business solutions we offer,

can help. Deep Insights guaranteed.